Formula of profit amount

Shows Growth Trends. Usually companies use this metric to help establish budgets forecast development potential and optimize investments.

Time Value Of Money Financial Mathematics Icezen Time Value Of Money Accounting And Finance Accounting Basics

This certain amount of profit is commonly known as target profit.

. Since it only measures profit in terms of dollar amount investors and other financial users usually find it difficult to use this metric to. The result of its profit formula is. Learn what net profit is how to calculate it using the net profit formula see some practical examples and how ProfitWell can help you get started.

There are two main reasons why net profit margin is useful. It is an indication of a companys. From the start youre accounting for your profit taxes and pay.

Service-based businesses calculate the formula slightly differently. Meaning of Gross Profit Formula. Find the profit or loss using the profit formula then convert it to a profit or loss percentage by expressing it as a fraction with the cost price as the denominator.

The sales revenue formula calculates revenue by multiplying the number of units sold by the average unit price. Return on investment ROI or return on costs ROC is a ratio between net income over a period and investment costs resulting from an investment of some resources at a point in time. The Profit First formula.

Having the right amount of inventory when and where its needed is a key element of corporate success. Profit and loss percentage are used to refer to the amount of profit or loss that has been incurred in terms of percentage. As an example of gross profit calculations pretend youre a coffee shop owner who sells a cup of espresso for 3.

The formula of profit percentage is given as follows. B Profit margin which is the percentage calculated using the selling. Thus the break-even point can be more simply computed as the point where Total Contribution Total Fixed Cost.

Net profit margin is an easy number to examine when reviewing the profit of a company over a certain period. The target profit formula is a calculation used by businesses to estimate how much revenue the company should produce over a set period of time. The formula for NPV doesnt distinguish a projects size or give favorability for higher ROI.

The formula for profit is very simple and it is expressed as the difference. Whats leftover is the budget your company has to spend on things like rent. By multiplying the number of customers by the average service price.

Profitability can be shown by calculating the gross profit using the gross profit formula. Paddle acquires ProfitWell to do it for you Get Profitwell Free Subscribe. A business generates 500000 of sales and incurs 492000 of expenses.

Example of the Profit Calculation. The profit formula is stated as a percentage where all expenses are first subtracted from sales and the result is divided by sales. Gross profit is an amount of money and gross profit margin is a financial ratio.

To calculate the profit margin divide the profit amount with cost price. The amount depends on the industry and the companys management. It is the marginal profit per unit or alternatively the portion of each sale that contributes to Fixed Costs.

In business and accounting net income also total comprehensive income net earnings net profit bottom line sales profit or credit sales is an entitys income minus cost of goods sold expenses depreciation and amortization interest and taxes for an accounting period. The Profit First formula puts profit first and encourages you to deduct profit from each sale and use the remaining amount for expenses. This can be converted in terms of percentage as well ie.

As a result todays CEOs are well versed in inventory strategies such as Just-in-time JIT collaborative planning forecasting and replenishment and shared point of sale. Then find the profit gained by the. This formula is derived by evaluating the companys situation to achieve the break-even point Break-even Point In accounting the break even point is the point or activity level at which the volume of sales or revenue exactly equals total expenses.

Profit Percentage fracProfittextCost Price x 100. Gross Profit Revenue - Cost of Revenue. In other words it is a point at which neither a profit nor a loss is made and the total cost and total revenue of the.

Gross Profit Formula Example. As a performance measure ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several. It is computed as the residual of all revenues and gains less all expenses and losses for the period.

The profit formula plays a major role in any income statement Income Statement The income statement is one of the companys financial reports that summarizes all of the companys revenues and expenses over time in. Option A might require an initial investment of 1 million while Option B may require an initial. Sales Profit Expenses.

Using the above formulas we can always estimate what is the profit or loss amount. The quantity is of interest in its own right and is called the Unit Contribution Margin C. It is the amount of profit before all interest and tax payments.

Target profit analysis is about finding out the estimated business activities to perform to earn a target profit during a certain period of time. The profit formula is used to calculate the amount of gain that has been made in a transaction. If the coffee costs 080 per cup to make and you sell 400 cups daily whats your daily gross profit.

The term profit refers to the financial benefit made when the amount of sales achieved from business exceeds the cost incurred in the process of the business activity. It is to be noted that the formula for NOPAT doesnt include the one-time losses or charges. Multiply the profit margin with 100 to get in percentage.

Calculate Book Profit Calculate Book Profit Book Profit is the profit amount that a business earns from its operations. The amount of gross profit left after subtracting the cost of revenue tells you a lot about how efficiently the company runs. To calculate the break-even point in terms of revenue.

Sales - Expenses Sales Profit formula. Many organizations use these two terms interchangeably to describe the amount. The profit percentage formula calculates the financial benefits left with the entity after it has paid all the expenses and is expressed as a percentage of cost price or selling price.

Gross profit is the money or profit that a company makes after the selling cost and receiving cost is deducted. Using the above formula Company XYZs net profit margin would be 30000 100000 30. A high ROI means the investments gains compare favourably to its cost.

For example lets imagine a coffee shop with 200000 in revenue sales per year. A Markup expressed as a percentage of cost price. When the Selling price of a product is greater than its Cost price a profit is earned.

Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65. Profit or loss. Profit percentage is of two types.

ABC is currently achieving a 65 percent gross profit in her furniture business. If a shopkeeper sells Apple at Rs200 per kg whose cost price is Rs150- per kg. After all losing control of inventory eats away at corporate profit margins and costs a firm its customers.

Subtract the cost price and selling price to get the profit amount. The formula of loss percentage is given as follows. Net Operating Profit After Tax Formula is also known as Net Operating Profit less adjusted Taxes NOPLAT.

Net Profit Margin Formula. Among these activities management is especially interested to find out the sales volume required to generate a target profit. Why Net Profit Margin Is Important.

This makes up the basic profit formula which further helps in generating the percentage of profit that has been earned in a business or while making a financial deal. It excludes the direct income and the expenses. Now lets take a look at the revenue formula itself in both forms.

How To Calculate Percentage Profit General Knowledge Facts Percentage Profit

Ideal Pricing Formula For Your Business Pricing Formula Business Plan Outline Business

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And Traditional Income Statement I Felt Like You Can Easily S

Pin On Marginal Approach

Net Income Formula Calculation And Example Net Income Accounting Education Income

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Financial Literacy Anchor Chart What Is A Bank What Do They Do Loan Financial Literacy Anchor Chart Financial Literacy Worksheets Financial Literacy Lessons

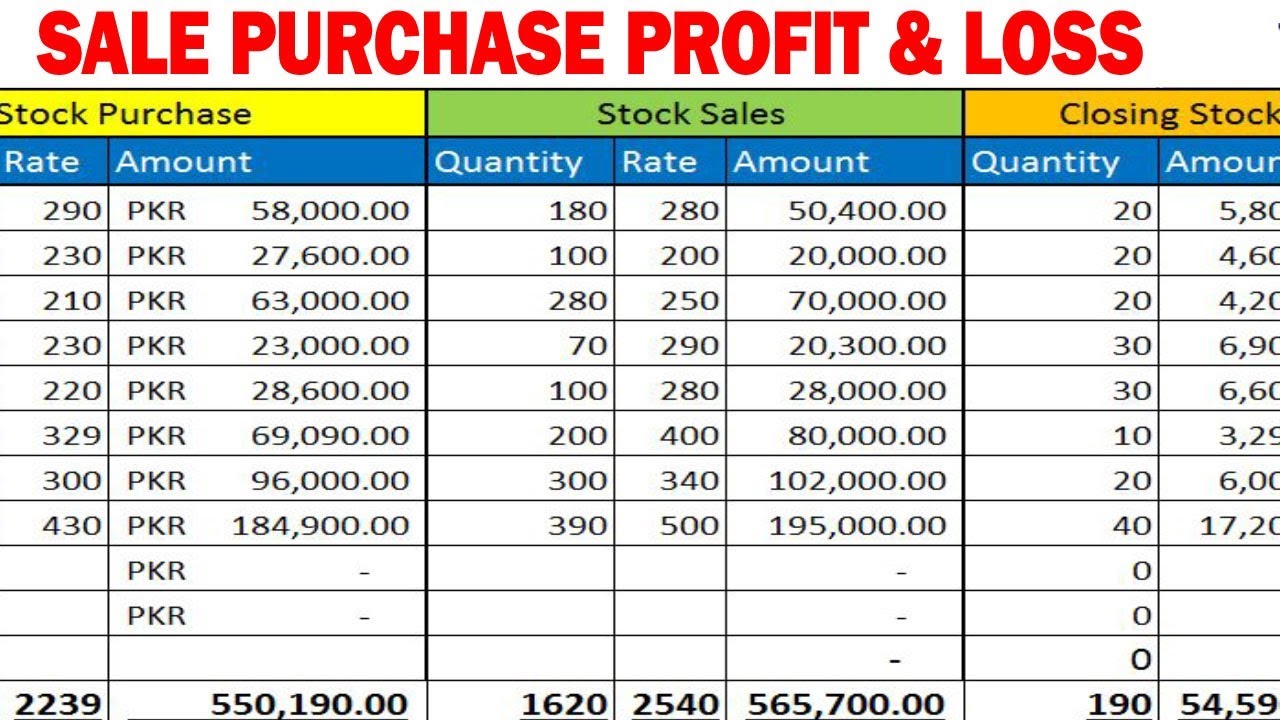

How To Make Stock Purchase Sales And Profit Loss Sheet In Excel By Lear How To Make Stock Learning Centers Excel Tutorials

Comparing Quantities Class 8 Notes Maths Chapter 8 Learn Cbse Class8mathsnotes Comparingquantitiesno Math Formula Chart Simple Interest Math Studying Math

Comparing Quantities Notes Class 8 Maths Cbse Math Methods Math Class 8

Calculating Profit Anchor Chart 4th Grade Math Financial Literacy Lessons Anchor Charts 4th Grade Math

Percentage Rs Aggarwal Class 7 Maths Solutions Exercise 10b Maths Solutions Math Class 8

Free Math Lesson Formulas Handout Go To The Best Of Teacher Entrepreneurs For This And Hundreds Of Free Le Free Math Lessons Math Lessons Homeschool Math

Simple Interest Compound Interest Continuously Compounded Interest Studying Math Math Methods Simple Interest Math

Gross Profit Percentage Meaning Example Advantages And More Accounting Education Economics Lessons Learn Accounting

Simple Interest Rs Aggarwal Class 7 Maths Solutions Exercise 12a Http Www Aplustopper Com Simple Inte Maths Solutions Simple Interest Simple Interest Math